Compound interest is the addition of interest to the total principal amount of the loan or deposit. In other words, the benefits outweigh the benefits. This is how it works. When you invest, you intend to make a profit over time. If you don't account for money plus interest, compound interest applies the interest rate to the total amount earned. Your money will accumulate over time.

However, simple interest does not accrue. They go away once you pay or earn interest over a period of time. They do not add to the next payment period like compound interest.

How does this work

If you invest $500 at the end of the year and earn 10% interest, you'll make $550 a year later. That is, the interest earned initially is $50. In the second year, you'll earn an additional $600 in interest that accrues year by year. Imagine if your money hasn't moved in 40 years, you'll accumulate $26,500. How charming.

Annual growth rate

CAGR is an important investment option associated with compound interest. It measures the growth of your investment over time. Investment funds provide great security for retirement planning. They don't have a fixed interest rate, and their value can fluctuate up and down. Choose mutual funds with good returns and good reputation.

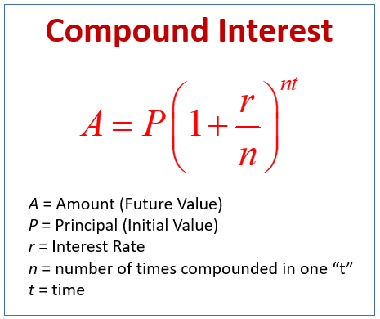

Formula

A=P(1+r/n)nt

P-principle

r Interest rate

n - how often the interest is compounded annually

t - the total number of years you have invested

A - Your final amount

How to grow wealth with compound interest

Compounding interest takes time to invest. Long-term self-discipline is the only way to achieve your desired financial goals. Interest paid is a penalty, and interest earned is a reward.

Increase donations every year

The average person is advised to devote at least 15% of their income to retirement. With this form of security, you will see your savings grow over the years.

Get out of debt

Compounding should work for you, not against you. This means you pay compound interest on your credit card. You will go bankrupt because the amount you pay back will keep increasing.

Start as soon as possible

Don't wait until you're old to invest your retirement savings. The more your savings remain in the account, the more money you have. Start investing in growth stock mutual funds early and reap the benefits.

Learn to be patient

A long-term mindset is the key secret to reap the benefits of this investment. Leave money behind for a long time. In this case, time is your best friend, and the longer you let money grow, the more it will grow.

Types of Compounding Accounts

Different investment accounts generate compound interest.

• Saving account

• Money market accounts

• Zero coupon bonds

• Dividend stocks

Generalize

Compounding interest can increase your retirement potential. A successful compounding process allows you to achieve a goal with less of your own money. High-interest credit card debt can make compounding a very expensive risk. Consult a professional to get started on your retirement financial goals.