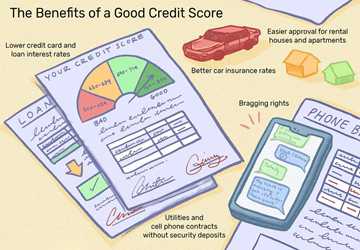

Nowadays credit score is a crucial part of a person’s financial portfolio. It basically shows if a person is good with money or not. So, if you have a bad credit score, you will get rejected by banks for getting a loan, you will have to pay high interest on mortgages, and will have to pay high premiums for the insurance you’ll buy.

Basically, if you don’t have a good credit score you will miss a lot of the opportunities of making your life financially better and that's why I am here to guide you about the easiest ways you can use to increase your credit scores.

Ways to Increase Your Credit Score

Use Your Credit Credit

The biggest mistake people make is that they don’t use their credit card at all and always shop with their debit card. They think they might end up paying interest if they can’t pay their credit card bills. I mean the main reason for getting a credit card should be to increase your credit score, you shouldn’t put it aside and only use it for emergencies.

The best thing to do is to use 9 to 30 percent of the credit card limit each month and pay back the money by the end of the month. Your credit score will increase exponentially. Just think of your credit card as debit card and set some money aside for it in your bank so you only spend the money you have and do not go over the limit.

Add Someone To Your Credit Card

Try to get a joint credit card with a family member who has a high credit score. You can use that credit card and your credit score will increase up to 100 points in a few months because of the high score of the person you have the joint credit card with.

This is the easiest way to increase your credit score exponentially so you should give it a try if you just got started with credit score.

Keep Old Accounts Don’t Open New Ones

Keeping an old account open increases the length of your credit score history. So, even if you aren’t using an account that you have paid for, don’t close it, keep it with you, and use it occasionally. Your credit score will keep increasing as the older your credit score history is, the faster your credit score will increase.

Also, opening many new accounts lead to the inquiry of your previous accounts and if they find a problem it can affect your credit score a lot. Plus, new accounts don’t tend to get you good results in increasing your credit score, so stay with your old accounts and keep using them.

Conclusion

To increase your credit score, you first have to set your mindset towards a goal and then slowly and gradually work towards it. Make a plan for increasing your score and implement the strategies you have set for that plan. For example, getting a joint credit card, or using 9 to 30 percent limit on your credit card are some strategies. It all depends on the plan you use and the work you put into it.