An asset class is a class of asset groups that have similar characteristics and are subject to the same laws and regulations. An asset class consists of instruments that perform similarly in the market. Asset allocation is performed in order to establish a certain percentage of the fund within each class. Portfolio managers use this asset class information to create diversified portfolios that can survive the market.

Fixed income

The fixed income asset class is one of the oldest forms of investing and one of the most popular investment choices for Indians. These include government and corporate bonds, money market bonds and corporate bonds. These investments make fixed payments on investments that are redeemed on specific dates. These asset classes invest in robust securities that pay investors interest when they mature.

Governments or corporations issue bonds to raise funds. Bonds provide investors with a steady stream of income for a period of time on an agreed-upon date. Therefore, they take less risk. Fixed-income securities issued by investment firms and governments expose investors to the risk of default or low returns if projects fail. The value of bonds is sensitive to changes in interest rates.

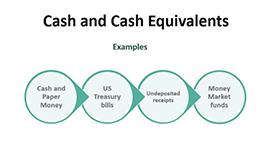

Cash and cash equivalent asset class

It is suitable for long-term short-term investment. Its liquidity makes it a key advantage over other options, providing convenience and security during involuntary hours. It has an easily available term loan ranging from three months to one year. Cash equivalents include Treasury bills, commercial paper and money market instruments.

Real assets

Real estate is based on tangible goods such as buildings, land, and oil barrels. Investors benefit from renting out or selling apartments, houses and industrial plants. The value of the real estate market increases or decreases depending on market conditions. Rental yields rise with the cost of living, giving investors an advantage over inflation. Commodities such as oil, wheat and gold generate returns based on supply and demand.

Stocks

Stocks are also called stocks. They are the owner's equity of the company. Shares are held through publicly traded shares, stock ownership, and private investments. The increase in the value of these companies creates wealth for shareholders. It comes in two ways, dividends and appreciation. Stock trading takes place physically or virtually. If both seller and buyer prices match, the transaction is successful.

Asset class investing strategy

Investment strategies for asset classes focus on asset returns. Investment strategies include value, income and growth to categorize and identify investment options by criteria. These criteria can be linked to performance and valuation matrices, such as price-to-earnings ratios or EPS growth. Others are less concerned with the type and class of assets. Investing in asset types or classes with similar characteristics tends to have similar cash flows.

Bottom line

Since the 1920s, the stock market has produced exceptional returns over extended periods of time. Financial advisors focus on asset classes to help investors diversify their portfolios to maximize their returns. Each asset class reflects different returns, risks, characteristics and considerations in each market environment.