Although it is very hard to predict when a market will bottom, astute traders may target a specific trading range using option methods such as the Iron Condor setup.

Many traders believe that Bitcoin's 2022 low of $17,580 was reached on June 18; nevertheless, (BTC) has failed to post a daily close of over $21,000 for the last week. The recent price behavior is unsettling traders, and the prospect of numerous CeFi and DeFi firms coping with the loss of user cash and potential insolvency dampens sentiment.

Two recent instances are the fallout from venture capital firm Three Arrows Capital (3AC) being unable to fulfill its financial commitments on June 14 lending site Babel Finance stopped withdrawals due to liquidity concerns.

Regulators had taken notice of this news, especially when Celsius, a cryptocurrency lending company, stopped allowing customer transactions on June 12. In addition, five American state securities watchdogs allegedly started looking into cryptocurrency lending sites on June 16.

Although it is impossible to predict when investor mood will shift and a Bitcoin bull run will begin, a low-risk strategy offers a respectable return with little risk for investors who think Bitcoin will hit $28,000 by August.

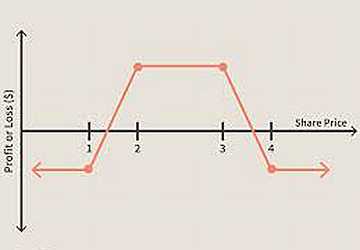

The "Iron Condor" provides benefits for a specific price range.

You may make "hail Mary" throws that infrequently work when you leverage futures contracts ten times.

But the majority of traders try to minimize losses while maximizing profits. For instance, the tilted "Iron Condor" minimizes losses if the expiration is below $22,000 but maximizes gains by around $28,000 by August.

The call option gives the right to purchase assets at a certain time. The customer pays a premium, which is an up-front cost, for this privilege.

The put option grants the investor the right to trade an asset at a certain price in the future as downside protection. Selling this asset (put), however, exposes a price increase.

Selling both put and call options at the same price and date of expiration is known as the Iron Condor. The above example was created using the contracts from August 26, but it may be modified for various timeframes.

The desired profit range is $23,850–35,250.

The investor has to short 3.4 agreements of the $26,100 call option or 3.5 contracts of the $26,100 put option to start the transaction. The buyer must then repeat the process for the $30,100 options using the same expiration month.

It is also necessary to purchase 7.9 arrangements of the put option with a strike price of $23,000 to hedge against any downside. In addition, another acquisition of 3.3 agreements of the $38,100 call option was made to prevent losses over the level.

If Bitcoin trades on August 26 between $23,350 and $35,150, this approach results in a net gain.

The amount needed to launch this strategy equals the maximum loss, or 0.28 BTC ($5,880), which will occur on August 26 if Btc trades under $23,000 or over $38,000. The benefit of this technique is that it gives a 125 percent return relative to the risk of loss while covering a reasonable goal range.